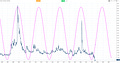

Dominant cycles speak one message: major trouble ahead for global stock markets (+ audio)

August Global Stock Market Cycles Update (Key Charts + Audio)

Upgrade to paid to play voiceover

(AUDIO: Please let me know in the comments if you like or dislike the audio voiceover with more personal comments.)

Keep reading with a 7-day free trial

Subscribe to Stock Market Cycles to keep reading this post and get 7 days of free access to the full post archives.