Treasury yield curve inversion and cycle model signal trouble for stock markets (+)

Watch out: Downside risk is larger than follow-through upside gains

Upgrade to paid to play voiceover

This is the “+” premium version with audio commentary, workbook link and active comments section to interact with this story.

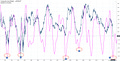

The following chart shows the 10 year US treasury minus the 1 year treasury spread curve in blue. The current yield curve is negative which results in an inverted yield curve. Attention is keenly focused on the yield curve slope a…

Keep reading with a 7-day free trial

Subscribe to Stock Market Cycles to keep reading this post and get 7 days of free access to the full post archives.